Budget is one such topic which is the backbone of most of our decisions. Whenever we think of making any significant decisions, budgeting comes into the picture. So, it is a habit that we have to adapt. But if you are among those who have never lived on a budget, then it is time to understand its importance. First, let’s get one thing clear – budgeting does not mean we have to compromise with our lifestyle or we have to let go our desires.

On the contrary, budgeting helps us in planning to make our future secure. It is essential because it enables you to control your spending, track your expenses, and save more money. In addition, it helps us make financial decisions, prepare for emergencies, get out of debt (if any), and stay focused on our long-term financial goals.

So, in this post, let us dive into the importance of budgeting how it can help us in our financial well-being.

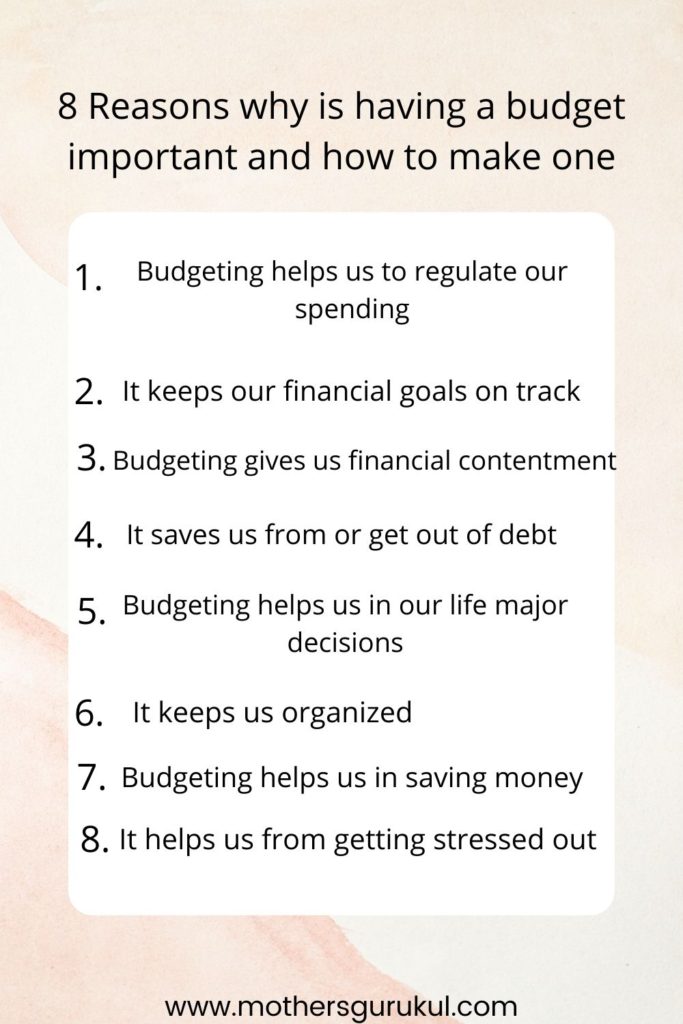

8 reason why having a budget is important

- Budgeting helps us to regulate our spending

- It keeps our financial goals on track

- Budgeting gives us financial contentment

- It saves us or get out of debt

- Budgeting helps us in our life decisions

- It keeps us organized

- Budgeting helps us in saving money

- It helps us from getting stressed out

Budgeting helps us to regulate our spending

Most of us think that living on a budget means controlling our spending. But if we see it in a way that allows us to regulate it and not restrict us from spending. When we operate our finances without a budget, we spend without thinking. For example, instead of making grocery trips once in two weeks versus making trips as and when required. This may seem very basic but can impact our monthly budget. If we have a budget in place, it helps us think about these small impacts as well.

Related article: Shop smartly with these 9 money saving ideas during the holiday season

It keeps our financial goals on track

We decide to cut down on our expenses, but we cannot implement it. It is like thinking of a goal but not putting it into action. Having a budget in place will help us in handling that part. If we have a specific monthly budget, then we can easily calculate how much to spend. Having a rough estimate in mind and having it adequately distributed among various things that we plan to do in one week/month/year helps us keep our financial goals on track. For example, during the holiday season, we know that our spending will be more. If we plan a thoughtfully drafted budget, it will help us see what expenses can be cut down or postponed to the following months. When you create a budget, we are setting boundaries on our financial behavior. It also helps us to assess our progress.

Budgeting gives us financial contentment

The progress that we have just talked about will provide us with a feeling of contentment to achieve our financial goals. In addition, we get influenced by the people around us. So, by having a budget, we are concentrating on our financial situation and priorities. Whenever we prepare a budget for our family, we think about our preferences, needs, family size, and which financial decisions can benefit us.

Related article: Why being content is the most important financial principle

It saves us from or get out of debt

You must have come across people who spend without thinking when they know that it is going out of their capacity. And the result is they get into the trap of heavy debts. Having a budget in place will not let this situation come. And in the worst case, it will help you get out of it.

If you need any professional help in this regard, then DebtConsolidation can give you a helping hand.

Budgeting helps us in our life major decisions

From a family’s point of view, having a budget or not having it is not a single person’s decision. You and your spouse should be on the same page. If one is a strong supporter of making calculative moves when it comes to money matters and the other is spending without thinking, it will be challenging to find a balance. And sometimes, it can even affect their relationship. A couple of months ago, I came across a matrimonial website that offers a questionnaire as part of their service. The questionnaire had many basic yet important questions that are a part of our routine and can become the reason for misunderstanding between the couple. One of them was spending habits and the importance of a budget.

Related article: 6 tips for a financially happy marriage

It keeps us organized

Without any doubt, keeping track of our financial well-being, not suppressing our needs but planning it properly, and having the entire family on the same page will lead us towards an organized life.

Budgeting helps us in saving money

Budgeting means saving – is that what you are thinking? Then please wait; I am not talking about how we can save money here. Instead I am talking about when we work around our finances, spending wisely becomes our second nature. It may not come naturally to some, but when they start doing it, they will automatically start seeing their savings, which they are happy doing after meeting all their necessary needs.

It helps us from getting stressed out

When our finances go out of control, it is obvious to feel stressed out. So the next thought is how we can bring it back on track and what expenses we can cut down to decrease the load. Budgeting saves us from feeling overwhelmed. When we have clarity about our income and expenditure, then we know how to keep it on track, and if by any reason it goes slightly off-track, then we know what to do.

These were the importance of having a budget. So now let’s see how to prepare one.

In a nutshell, it is about calculating your income and distributing it as per your needs. But this can be influenced by other factors.

How to prepare a budget in 6 easy steps:

- Calculate your net income

- Track your spendings

- Make SMART goals about how much you can spend (Smart, Measurable, Achievable, Realistic, Time-framed)

- Make a plan

- Be flexible about your spending habits to achieve the goal

- Keep checking your progress and make future moves accordingly

Final thoughts:

A budget tells you how much money you have and how much you can spend. It is not restricting you from sending but making you a better shopper.

You speak my mind, it’s so important to make and budget and write the expenses down. I keep telling my husband but he just won’t listen. The tips you shared are so doable

It helps us in staying on track.

Agree with all the reasons Alpana. budgeting may seems like an extra task in the beginning but in long run, it can help a lot in managing our finances and saving money for future. you have explained all reasons very nicely in this post.

Thank you

Budget making is surely important and if done in right manner then life is easy. Rightly said that one can come out of debt if budget is planned well and professional help is added advantage to come out of crisis.

Yes

Such a thoughtful post. During Lockdown only I have started this as becoming a habit too. Such a great piece of advice. Thank you 😊

Thank you